Difference between revisions of "Other Crop Summary"

| Line 13: | Line 13: | ||

[[File:Gross Margin Formula.png|1000px|frameless|center|link=]] | [[File:Gross Margin Formula.png|1000px|frameless|center|link=]] | ||

====Operating | ====Operating Return==== | ||

If growers are evaluating the profitability of growing fallow crops they have not grown before then they would need to consider any changes in fixed costs that might occur and/or any required capital expenditures on new equipment. If so, a comparison of operating return would be a more precise indicator of relative profitability, which would require completion of the [[Assets]], [[Depreciation]] and [[Fixed Costs]] pages. | If growers are evaluating the profitability of growing fallow crops they have not grown before then they would need to consider any changes in fixed costs that might occur and/or any required capital expenditures on new equipment. If so, a comparison of '''operating return''' would be a more precise indicator of relative profitability, which would require completion of the [[Assets]], [[Depreciation]] and [[Fixed Costs]] pages. '''Operating return''' is displayed on the [[Profit]] page. | ||

Revision as of 05:21, 15 June 2023

What is this page?

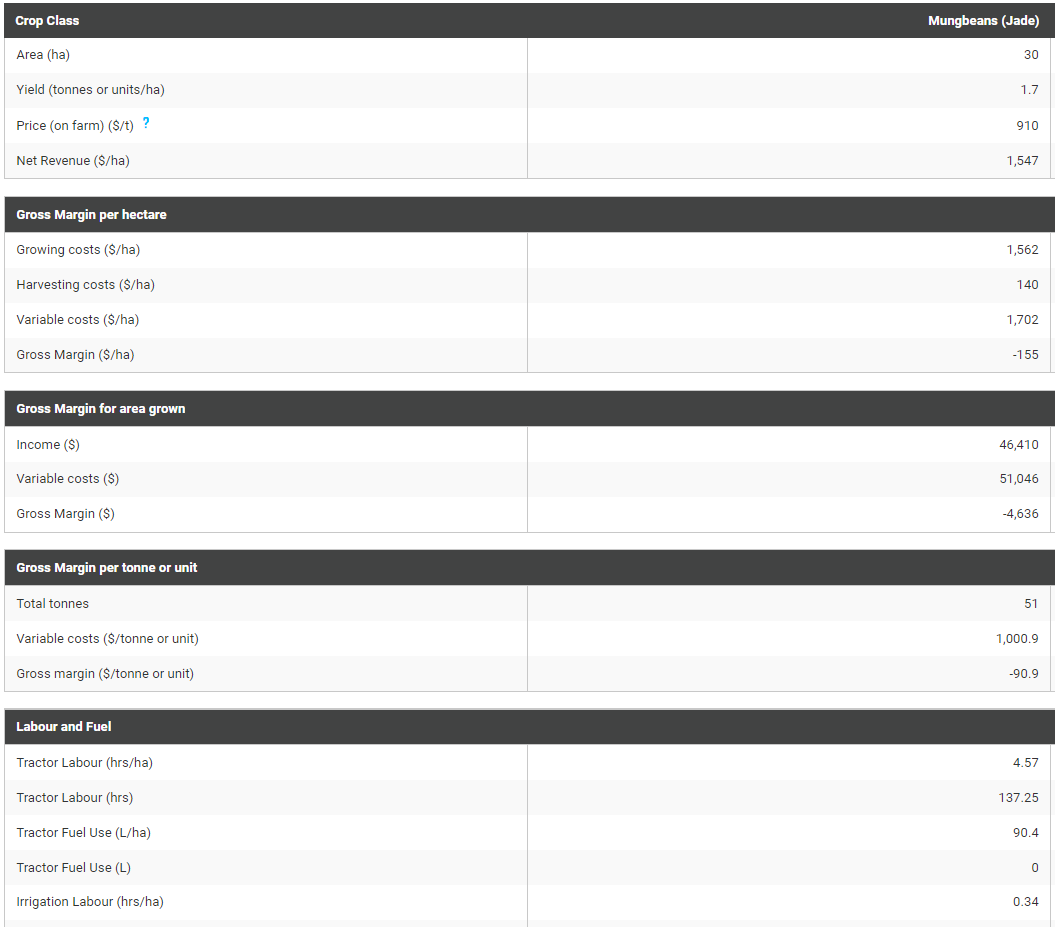

This page is a summary of gross margin information based on information entered on the Other Crop Assumptions, Other Crops Growing Costs and Scenario Assumptions pages.

This page displays all other crops and no entry of information is required.

Tip: This page can be printed or saved as a PDF by right clicking on the page and selecting "Print".

Economic Theory

Gross Margin

Gross margins are calculated by subtracting variable costs from gross income. Comparing the gross margins of different fallow crops is informative and helps you to make fallow crops choices that enhance whole-of-farm profitability.

If you were only aiming to develop a gross margin then you can skip to the Farm Performance Indicators page.

Operating Return

If growers are evaluating the profitability of growing fallow crops they have not grown before then they would need to consider any changes in fixed costs that might occur and/or any required capital expenditures on new equipment. If so, a comparison of operating return would be a more precise indicator of relative profitability, which would require completion of the Assets, Depreciation and Fixed Costs pages. Operating return is displayed on the Profit page.