Difference between revisions of "Depreciation"

| Line 30: | Line 30: | ||

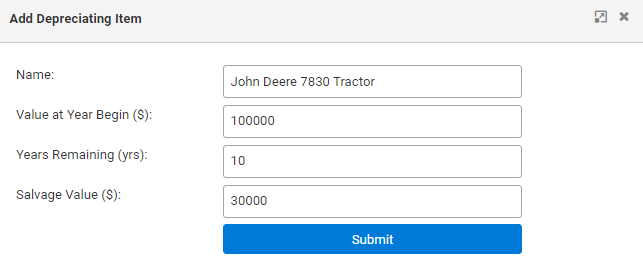

'''1. Press "Add Depreciating Item".''' | '''1. Press "Add Depreciating Item".''' | ||

'''2. Enter the name of the depreciating asset.''' For example, John Deere 7830 Tractor. | '''2. Enter the name of the depreciating asset.''' For example, John Deere 7830 Tractor. | ||

Revision as of 23:44, 28 June 2023

Why include depreciation?

Depreciation is regarded as a fixed cost. Unlike other fixed costs there is no cash flow for depreciation. So why include it when calculating profit? At some point assets will wear out and need to be replaced. Including depreciation ensures that profit is sufficient to cover their eventual replacement.

- Note: in FEAT Online, the only asset class that is included in depreciation calculations is Plant & Machinery.

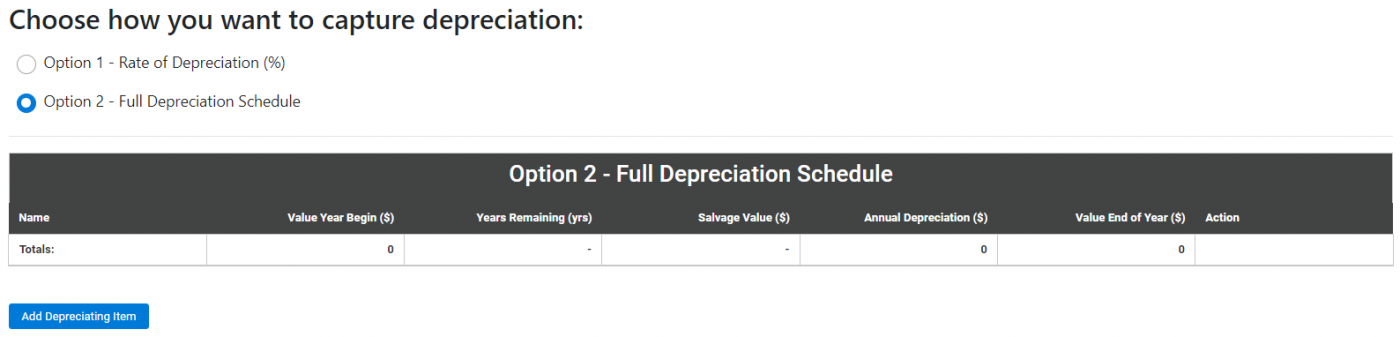

You have two options on how to include Depreciation:

Option 1

1. Enter the depreciation rate (e.g. 10%).

2. Navigate to the Assets page and enter the total value of all depreciating assets.

(a) Click "Add Asset".

(b) Select "Plant and Machinery".

(c) Enter a name and the total value of all depreciating assets (e.g. $350,000).

3. Navigate back to the Depreciation page and "Annual depreciation on plant and machinery (entered on Assets page)" will be displayed at the bottom of the page.

Option 2

Complete the Depreciation Schedule with information about every tractor, implement and other types of depreciating assets (e.g. vehicles, pumps and equipment).

1. Press "Add Depreciating Item".

2. Enter the name of the depreciating asset. For example, John Deere 7830 Tractor.

3. Enter the value at beginning of year in dollars ($). For example, $100,000.

4. Enter the number of years of use remaining (years). For example, 10 years.

5. Enter the residual salvage value in dollars ($). For example, $30,000.

- Residual salvage value is an estimate of how much the depreciating asset could be sold for at the end of the ‘Number of years of use remaining’.

- You can only choose one of the above-mentioned options otherwise depreciation costs will be included twice – and therefore double counted.

Option 2 Calculation

Annual depreciation is calculated in FEAT according to the formula:

Annual depreciation = (Value at beginning of year – Residual salvage value)/(Number of years of use remaining)

Value at end of year = value at beginning of year – annual depreciation

The average of the opening value of all items (a) and the closing value (b) is transferred to the Assets page and displayed in the assets table.