Difference between revisions of "Assets"

Jump to navigation

Jump to search

| Line 11: | Line 11: | ||

[[File:Assets 2.png|1400px|frameless|center]] | [[File:Assets 2.png|1400px|frameless|center|link=]] | ||

[[File:Add Asset.png|1000px|frame|center]] | [[File:Add Asset.png|1000px|frame|center|link=]] | ||

[[Depreciation]] ⇐|⇒ [[Fixed Costs]] | [[Depreciation]] ⇐|⇒ [[Fixed Costs]] | ||

Revision as of 00:01, 7 February 2023

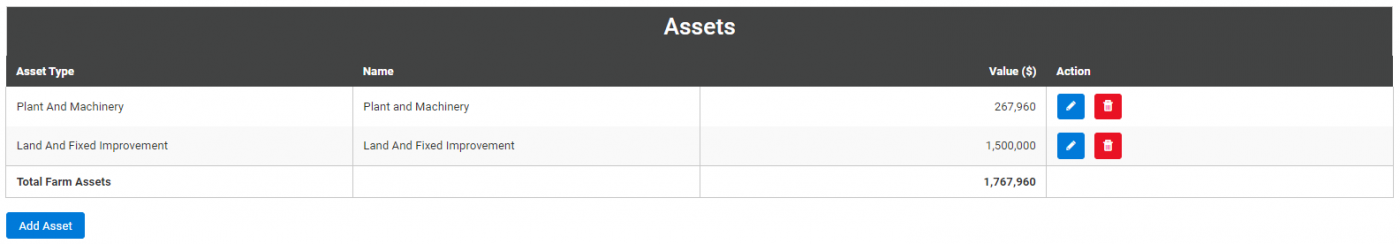

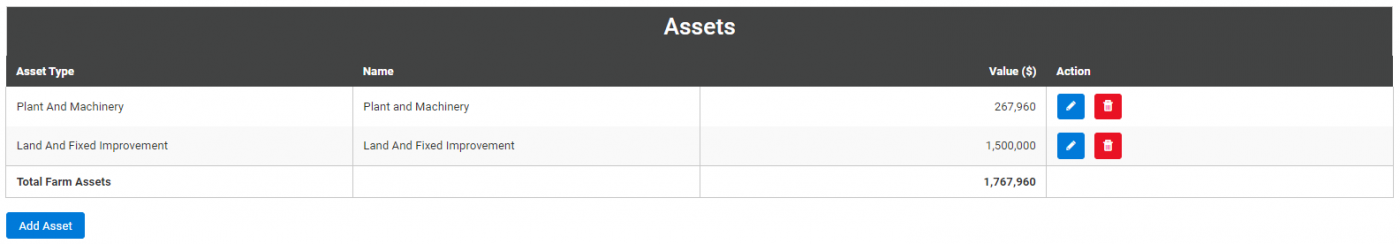

This page is used to record total farm assets. Values for Plant & Machinery can then be applied with a Depreciation rate to calculate a total Annual Depreciation figure, shown in the Fixed Costs page. Values for this and the remaining asset types (Land & Fixed Improvements, Inventories, Livestock and Other) are used in the calculations for Return on Investment (%) in the Profit page.

Please note, the remaining asset types will not form part of the depreciation costs.

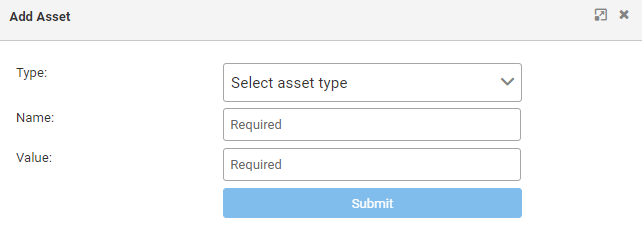

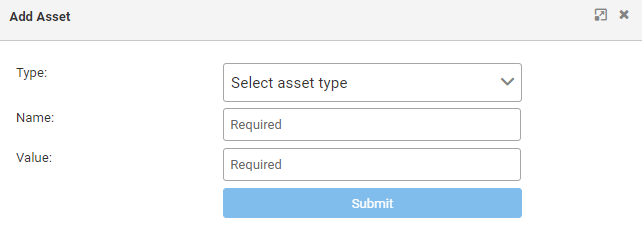

Add assets by following these steps:

- Enter an estimated value of your land including the value of all fixed improvements ($). For example, dams, buildings, etc.

- If you have entered machinery values (etc.) into the full Depreciation Schedule (using option 2), the value of plant and machinery will be shown here. If not, then please enter an estimated current value of all plant and machinery.

- Enter the value of any livestock ($), if applicable.

- Estimate the value of any inventory ($). For example, fertiliser.

- Enter additional assets as required ($).