Difference between revisions of "Cane Summary"

| Line 7: | Line 7: | ||

====Economic Theory==== | ====Economic Theory==== | ||

Gross margins are calculated by subtracting variable costs from gross income. Comparing the cane gross margins of two different farming systems is a useful way to examine the profitability of adopting new management practices, which helps to inform farm management decisions. | Gross margins are calculated by subtracting variable costs from gross income. Comparing the cane gross margins of two different farming systems is a useful way to examine the profitability of adopting new management practices, which helps to inform farm management decisions. | ||

[[File:Gross Margin Formula.png|1000px|frameless|center]] | [[File:Gross Margin Formula.png|1000px|frameless|center|link=]] | ||

| Line 13: | Line 13: | ||

[[File:Cane Summary 2.png |1400px|frameless|center]] | [[File:Cane Summary 2.png |1400px|frameless|center|link=]] | ||

[[Cane Growing Costs]] ⇐|⇒ [[Other Crop Assumptions]] | [[Cane Growing Costs]] ⇐|⇒ [[Other Crop Assumptions]] | ||

Revision as of 23:43, 6 February 2023

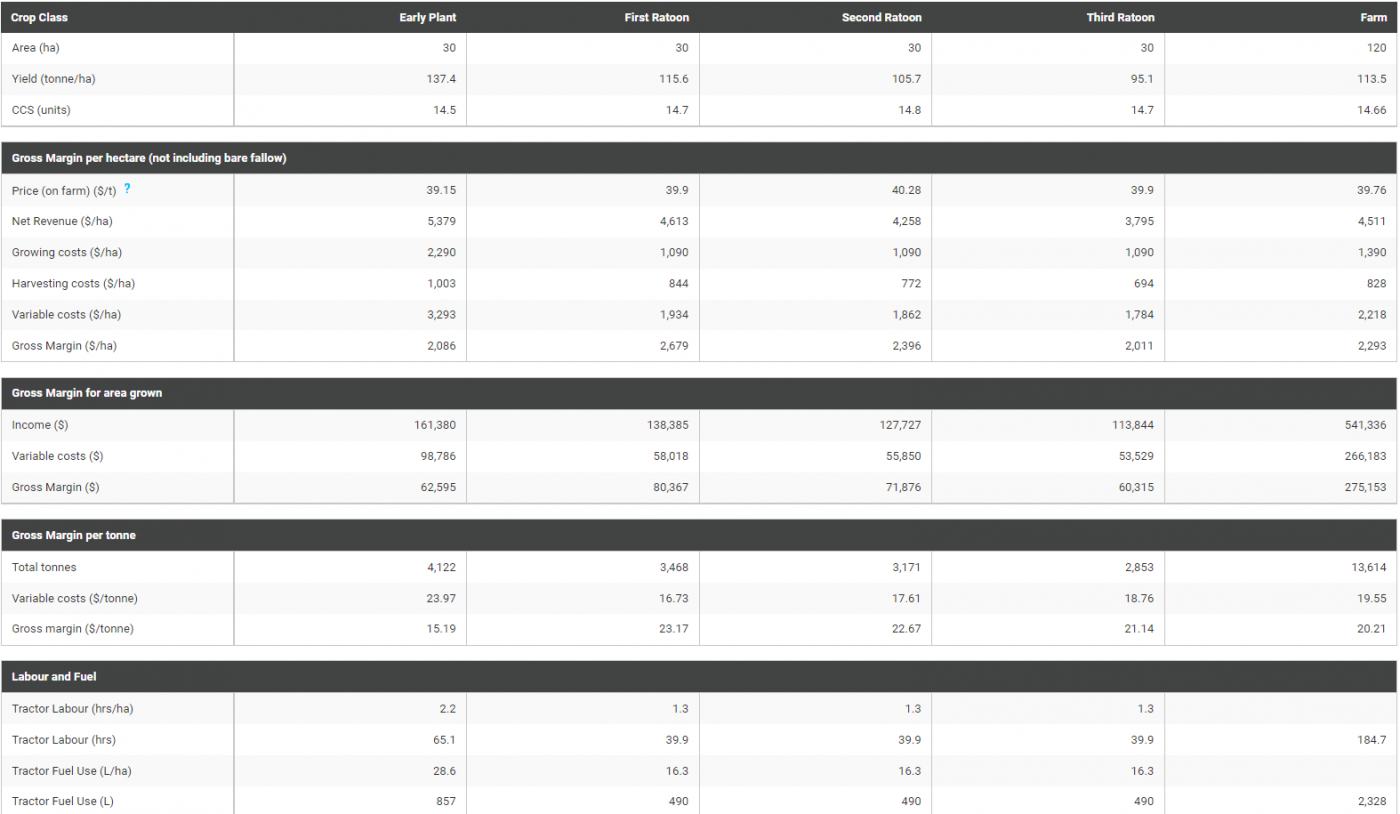

This page is a summary of gross margin information based on information entered on the Cane Assumptions, Cane Growing Costs and Scenario Assumptions pages.

This page displays all cane crop classes, a farm column and no entry of information is required.

Tip: This page can be printed or saved as a PDF by right clicking on the table and selecting "Print".

Economic Theory

Gross margins are calculated by subtracting variable costs from gross income. Comparing the cane gross margins of two different farming systems is a useful way to examine the profitability of adopting new management practices, which helps to inform farm management decisions.

However, farm managers also need to account for any changes in fixed costs that might occur from the adoption of new practices as well as any required capital expenditures on new equipment. If so, a comparison of operating return would be a more precise indicator of relative profitability, which would require completion of the Depreciation, Assets and Fixed Costs pages.